Financial literacy doesn’t come naturally to everyone. Many of us grow up without the tools or knowledge to manage money confidently, and we end up learning the hard way.

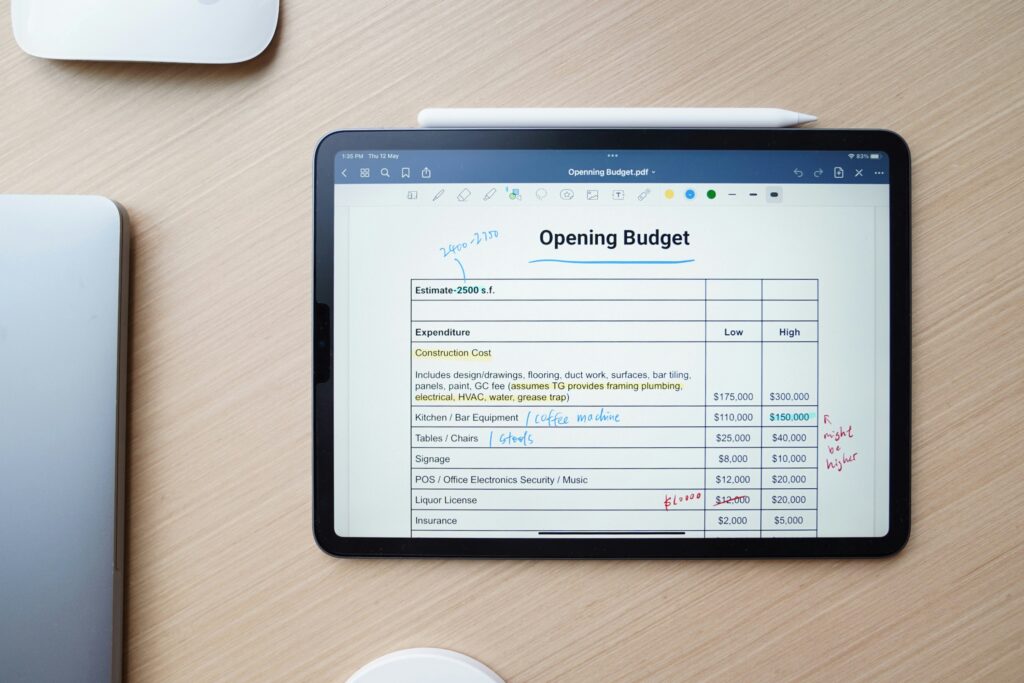

We often assume budgeting means tracking expenses on a spreadsheet. But let’s be honest, it’s time-consuming, clunky, and prone to mistakes.

Thankfully, that’s changing. If we rely on technology for everything else, why not for our finances?

AI can’t do your laundry (yet 😮💨), but it can help you take control of your money.

From budgeting and expense tracking to personalized financial advice, AI-powered apps are transforming how we manage our finances, smartly and in real time.

In this article, we’ll explore how AI is reshaping the way we budget and spend.

Is Traditional Budgeting Really That Bad?

Without a doubt of a second we know, traditional budgeting has been the go-to method for managing money for a very long time.

It works on the highly structured and familiar method that is based on several things, like:

- Past spending

- Future predictions

- Helping set goals

- Divide up resources

- Measure progress

That is why so many people still use it.

But the world has changed a lot, and it is changing.

Now, personal finances are running like a wild horse, but traditional budgeting is too slow and rigid to keep up with this world.

It is a time when flexibility and quick decision-making matter more than ever, isn’t it? So, why can’t you ask if there is any other method that we can follow?

So, the answer is yes, But If you’re still using old methods to manage your money, now we would like to tell you to seek help from AI.

An easier and smarter way to take control of your finances, but how? Let us explain!

How AI AI-driven budgeting have an edge over traditional budgeting?

We now have a wave of AI-powered finance apps that are making things easier and smarter. These apps have the ability to go beyond tracking your spending as they use automation and smart predictions to help you stay ahead with your money.

AI apps are your financial assistants, as they will:

- Learn your habits

- Suggest ways to save

- Manage debt

- Help with future investing.

Tools For Your Future Budgeting Adventure

For your next budgeting journey, use one of these AI tools, as it can save you time, money, and stress. Now, no need to switch platforms.

If you’re really into AI-powered personal finance apps and are looking forward to upgrading to handling your finances in 2025, here are some app suggestions.

- Cleo:

Enhance your fun with this AI-powered chatbot that will help you to keep track of spending, set budgets, and will even throw in some humor while giving real-time financial tips.

- Digit:

So with Digit, all your income and spending habits will be studied, and it also has the ability to save small amounts without you even noticing. It is like saving on autopilot.

- Rocket Money:

You can use Rocket Money for spotting sneaky subscriptions. This tool also offers a “Smart Savings” feature, which will help you stash away extra cash.

- Albert:

Albert gives you personalized money advice and automates savings. It works with both of powers, AI and real human experts

- Magnifi:

If you want an AI investing assistant, use Magnifi as it will guide you through research, build your portfolio, and make smart investing decisions with simple and conversational help.

- Qapital:

This tool will let you save money by using your personalized rules. For example, if you want to skip eating pizza on Tuesday, Qapital will make it automatic and fun.

- Trim:

It will analyze your spending, help negotiate lower bills, and cancel all the subscriptions you’re no longer using, ultimately a money-saving assistant in your pocket.

- QuickBooks:

If you want to support small business budgeting, then QuickBooks is for you. It is not just accounting software; QuickBooks uses AI to forecast cash flow, generate reports.

- Empower:

As its name shows, Empower helps you to empower yourself with budgeting, saving, and investing by using AI to tailor advice and actions to your lifestyle.

Conclusion

AI has also stepped into powering a new generation of personal finance apps that are making budgeting smarter, easier, and more personalized. Instead of using traditional spreadsheets and manual tracking, these AI-driven tools use automation, real-time data, and smart advice to help users take better control of their money.

These apps are not just replacing our old-school budgeting tools; they’re giving us a way to take control of our financial lives, and that too with less effort and more results.

If you’re trying to save more, invest smarter, or just want to stop overspending, seek the help of these AI tools now.